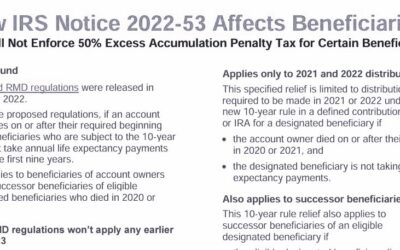

New Infographic – How IRS Notice 2024-35 Affects Beneficiaries

A new infographic is now available that describes how IRS Notice 2024-35 affects beneficiaries who...

529 Plan-to-Roth IRA Rollovers

I’ve heard that there’s a new option for savings in 529 plans to be rolled over to an IRA. Is this...

IRS Provides Further RMD Transition Relief Under the SECURE Act

On April 16, 2024, the IRS issued Notice 2024-35 to provide additional transition relief for...

Naming a Trust as IRA Beneficiary

Are you considering naming a trust as your IRA beneficiary? Here are 5 things to know beforehand....

IRS Issues Proposed Long-Term, Part-Time Regulations

The Internal Revenue Service (IRS) has released a proposed regulation reflecting statutory changes...

Roth IRAs – Addressing the Intricacies of Conversions and Rollovers

I have a client who has pretax assets in both a Traditional IRA and a 401(k) plan. She would like...