529 Plan-to-Roth IRA Rollovers

I’ve heard that there’s a new option for savings in 529 plans to be rolled over to an IRA. Is this true? The SECURE Act of 2022—also known as SECURE 2.0—made many changes to tax-advantaged savings arrangements. Not all SECURE 2.0 provisions took effect immediately....

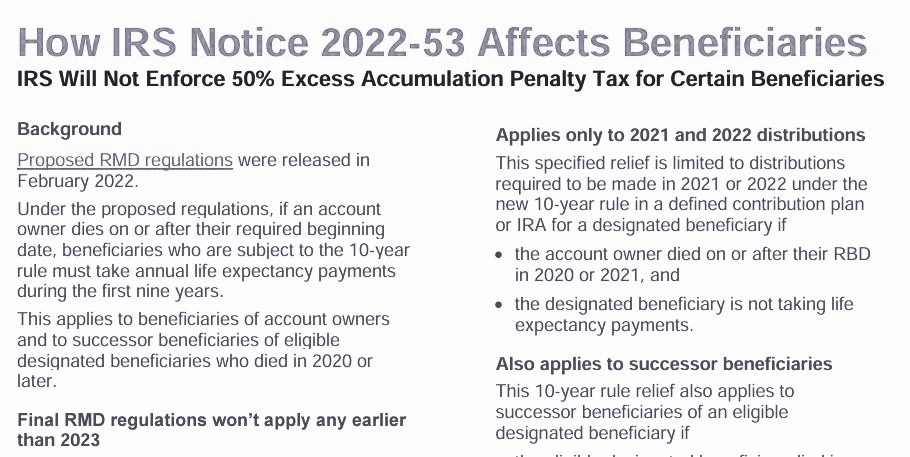

IRS Provides Further RMD Transition Relief Under the SECURE Act

On April 16, 2024, the IRS issued Notice 2024-35 to provide additional transition relief for certain specified RMDs for 2024. Specified RMDs for 2024 This guidance is similar to relief announced for previous specified periods under IRS Notice 2022-53 and Notice...

IRS Issues Proposed Long-Term, Part-Time Regulations

The Internal Revenue Service (IRS) has released a proposed regulation reflecting statutory changes related to long-term, part-time (LTPT) employees made by the SECURE Act of 2019 (SECURE Act) and the SECURE 2.0 Act of 2022 (SECURE 2.0). This proposed regulation would...

SECURE 2.0 Adds New Penalty-Free Distribution Option for Certain Emergency Expenses

This article is part of a multi-part series that describes the penalty-free distribution options created by SECURE 2.0 Distributions taken from qualified plans and IRAs before age 59½ are often subject to a 10 percent early distribution penalty tax. But numerous...