Industry News

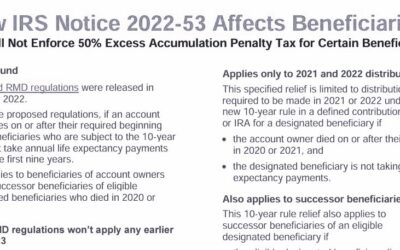

New Infographic – How IRS Notice 2024-35 Affects Beneficiaries

A new infographic is now available that describes how IRS Notice 2024-35 affects beneficiaries who are subject to the 10-year rule and must take annual life expectancy payments during each of the...

529 Plan-to-Roth IRA Rollovers

I’ve heard that there’s a new option for savings in 529 plans to be rolled over to an IRA. Is this true? The SECURE Act of 2022—also known as SECURE 2.0—made many changes to tax-advantaged savings...

IRS Provides Further RMD Transition Relief Under the SECURE Act

On April 16, 2024, the IRS issued Notice 2024-35 to provide additional transition relief for certain specified RMDs for 2024. Specified RMDs for 2024 This guidance is similar to relief announced for...

IRS Issues Proposed Long-Term, Part-Time Regulations

The Internal Revenue Service (IRS) has released a proposed regulation reflecting statutory changes related to long-term, part-time (LTPT) employees made by the SECURE Act of 2019 (SECURE Act) and...

SECURE 2.0 Adds New Penalty-Free Distribution Option for Certain Emergency Expenses

This article is part of a multi-part series that describes the penalty-free distribution options created by SECURE 2.0 Distributions taken from qualified plans and IRAs before age 59½ are often...

SECURE 2.0 Provides New Ways to Take Penalty-Free Distributions

The SECURE 2.0 Act provides more ways for individuals to access their retirement savings and creates new exceptions to the 10 percent early distribution penalty tax. Normally, IRA owners and...