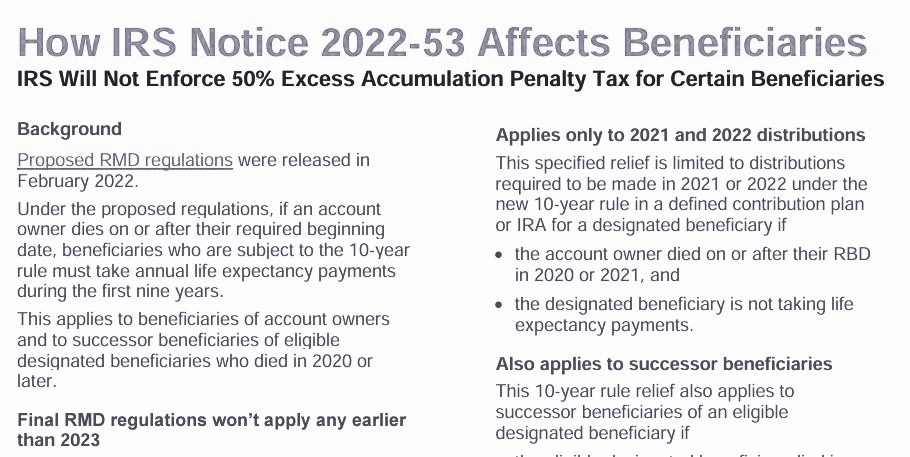

New Infographic – How IRS Notice 2024-35 Affects Beneficiaries

A new infographic is now available that describes how IRS Notice 2024-35 affects beneficiaries who are subject to the 10-year rule and must take annual life expectancy payments during each of the first nine years after becoming a beneficiary of an account owner’s...

529 Plan-to-Roth IRA Rollovers

I’ve heard that there’s a new option for savings in 529 plans to be rolled over to an IRA. Is this true? The SECURE Act of 2022—also known as SECURE 2.0—made many changes to tax-advantaged savings arrangements. Not all SECURE 2.0 provisions took effect immediately....

IRS Provides Further RMD Transition Relief Under the SECURE Act

On April 16, 2024, the IRS issued Notice 2024-35 to provide additional transition relief for certain specified RMDs for 2024. Specified RMDs for 2024 This guidance is similar to relief announced for previous specified periods under IRS Notice 2022-53 and Notice...

Naming a Trust as IRA Beneficiary

Are you considering naming a trust as your IRA beneficiary? Here are 5 things to know beforehand. Naming a trust your IRA beneficiary is much less common than naming one or more persons, but it is not altogether rare. Unlike a will—which essentially only identifies...

IRS Issues Proposed Long-Term, Part-Time Regulations

The Internal Revenue Service (IRS) has released a proposed regulation reflecting statutory changes related to long-term, part-time (LTPT) employees made by the SECURE Act of 2019 (SECURE Act) and the SECURE 2.0 Act of 2022 (SECURE 2.0). This proposed regulation would...

Roth IRAs – Addressing the Intricacies of Conversions and Rollovers

I have a client who has pretax assets in both a Traditional IRA and a 401(k) plan. She would like to move both accounts to a Roth IRA. Are there any limitations that would prevent her from doing this? Individuals may simultaneously convert Traditional IRA assets and...

A Refresher on Recharacterizations

One of our IRA owners died last year. His daughter, who is the executrix of his estate, came in today and asked to recharacterize his 2021 Roth IRA contribution because he was not eligible to make that contribution. May she do this? Yes. According to Treasury...

IRA Excess Contributions and How to Handle Them

IRA owners sometimes contribute more than they are permitted. Or they may contribute only to later discover that they cannot deduct the contribution. And sometimes they simply want to take the contribution out for some other reason. Whatever the situation, IRA...