529 Plan-to-Roth IRA Rollovers

I’ve heard that there’s a new option for savings in 529 plans to be rolled over to an IRA. Is this true? The SECURE Act of 2022—also known as SECURE 2.0—made many changes to tax-advantaged savings arrangements. Not all SECURE 2.0 provisions took effect immediately....

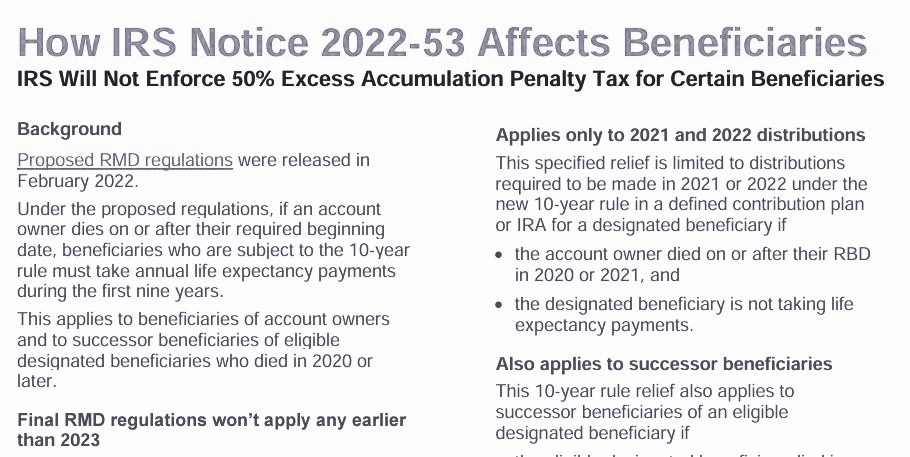

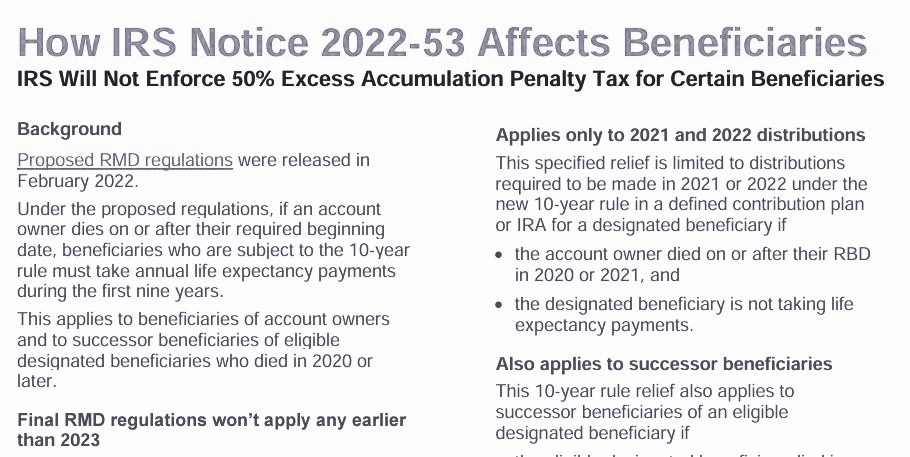

IRS Provides Further RMD Transition Relief Under the SECURE Act

On April 16, 2024, the IRS issued Notice 2024-35 to provide additional transition relief for certain specified RMDs for 2024. Specified RMDs for 2024 This guidance is similar to relief announced for previous specified periods under IRS Notice 2022-53 and Notice...

Naming a Trust as IRA Beneficiary

Are you considering naming a trust as your IRA beneficiary? Here are 5 things to know beforehand. Naming a trust your IRA beneficiary is much less common than naming one or more persons, but it is not altogether rare. Unlike a will—which essentially only identifies...