Cost of Living Adjustment (COLA) Limits

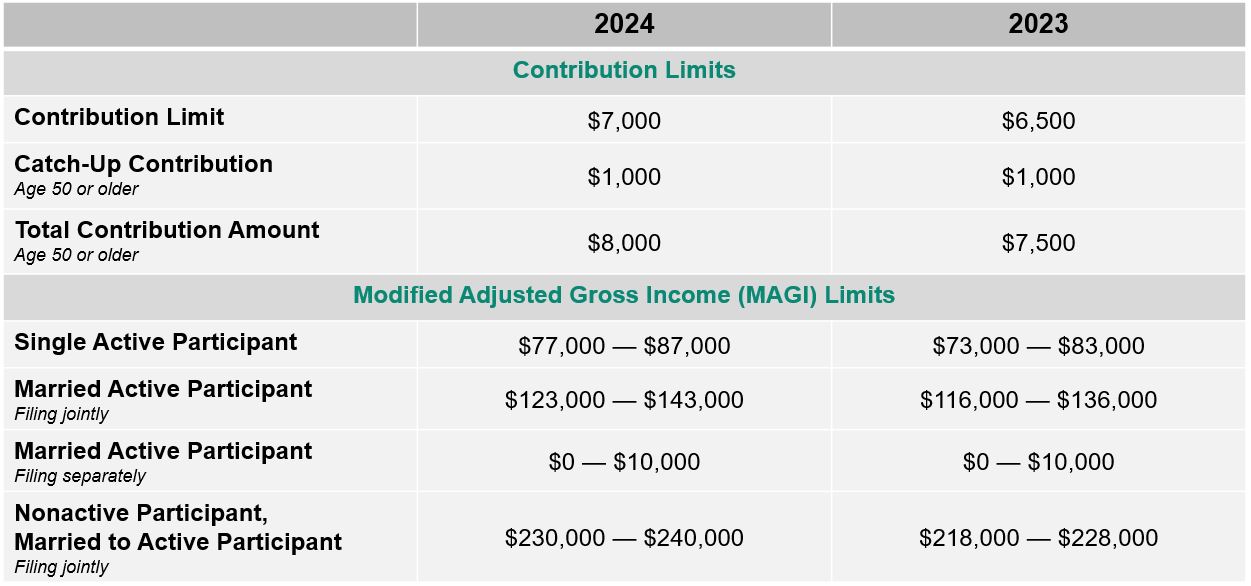

Traditional IRAs

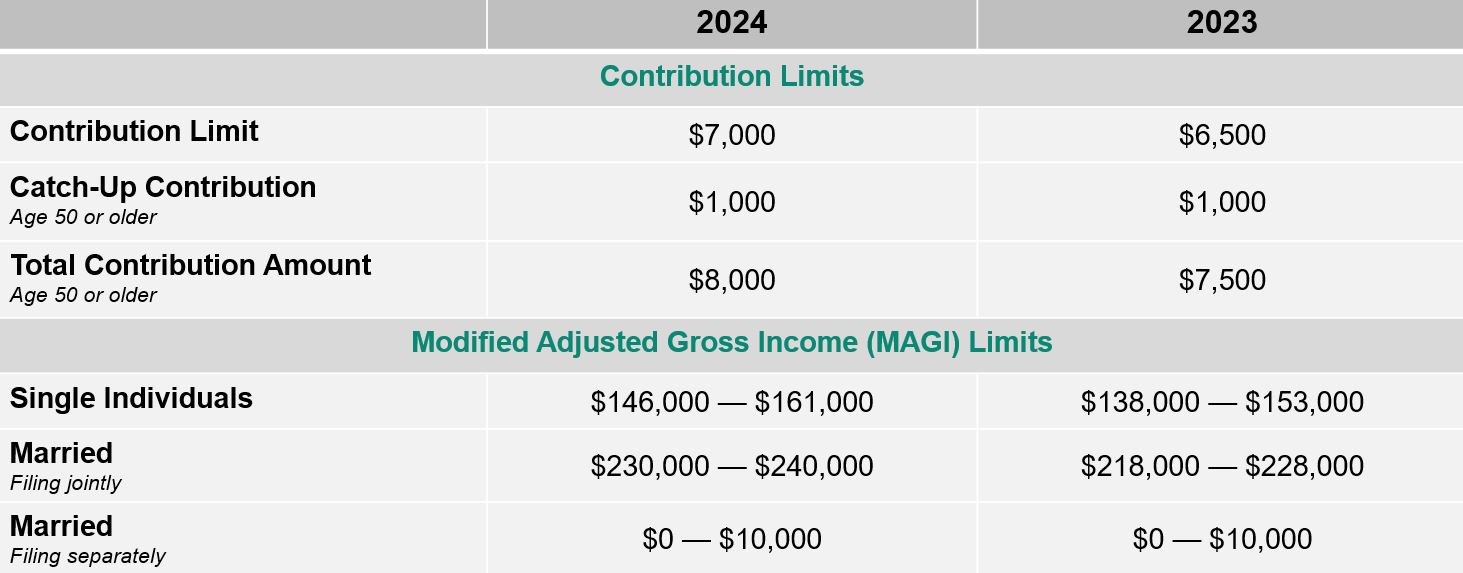

Roth IRAs

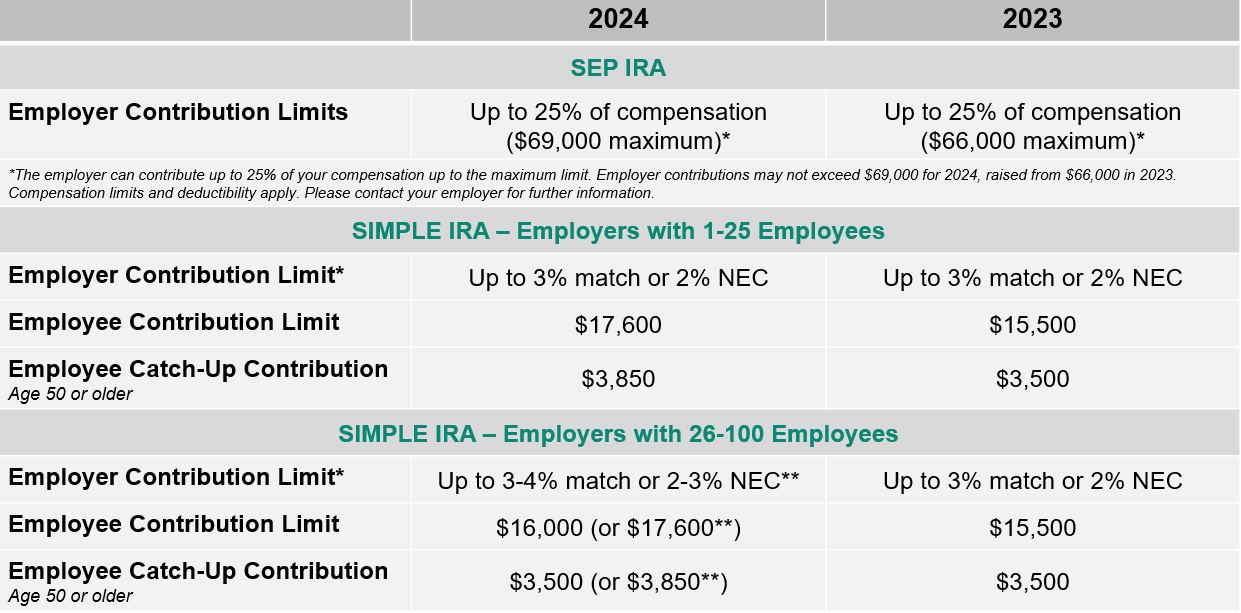

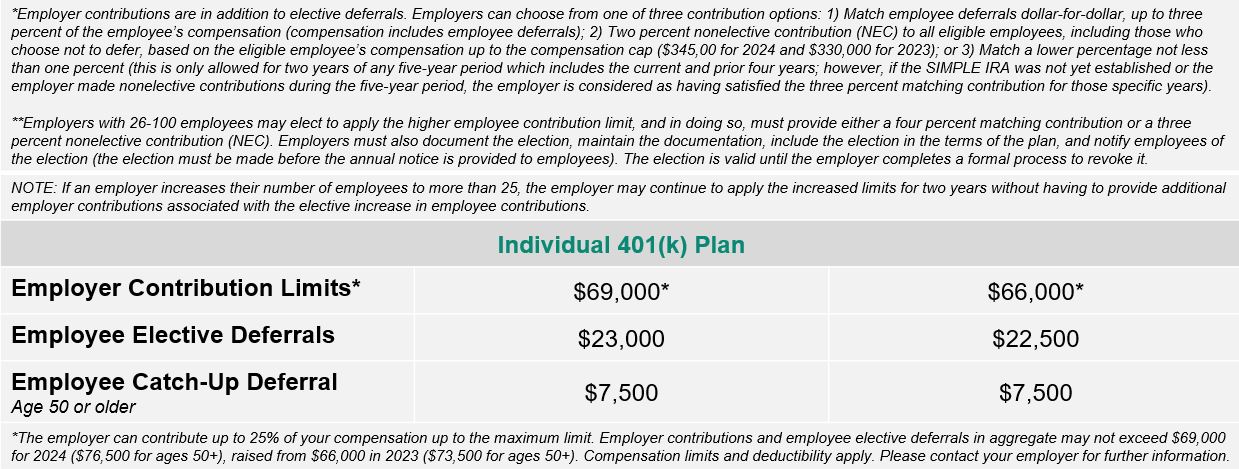

Small Business Retirement Plans

We do not offer investment, tax, financial, or legal advice to clients. Individuals who believe they need advice should consult with qualified professional(s) licensed in that area. This section of our website is devoted to providing clients and potential clients with educational information. It is in no way intended as tax advice.